Here are the 3 best ways to use Amazon Pay Balance or cashback earned on Amazon – so that it doesn’t just sit there but actually does what it’s supposed to do, help you save! In this article, we’ve put in a lot of effort and research to try to answer all your questions related to using Amazon Pay Cashback such as; (1) Best ways to use cashback earned on Amazon? (2) Can you use Amazon cashback for recharge (3) How to transfer Amazon Pay balance to bank account (4) Other 3rd-party apps that accept Amazon Pay balance as payment (5) Amazon Pay Cashback terms and conditions and (6) Amazon Pay Cashback Limit per month

.

What is Amazon Pay Cashback?

Amazon Pay Cashback is a reward credited to your Amazon Pay balance. Users earn cashback on Amazon for shopping, collecting cashback rewards, participating in Amazon Spin & Win contests, using Amazon Pay UPI and other eligible transactions. The Amazon Pay Cashback unlike wallet balance cannot be transferred.

Before we proceed to knowing some of the best ways to use cashback earned in Amazon or how to use Amazon Pay Balance, you must understand the difference between Amazon Pay Wallet vs Amazon Pay Cashback vs Amazon Pay Balance vs Gift Vouchers Balance.

Difference Between Amazon Pay Balance vs Amazon Wallet vs Amazon Cashback

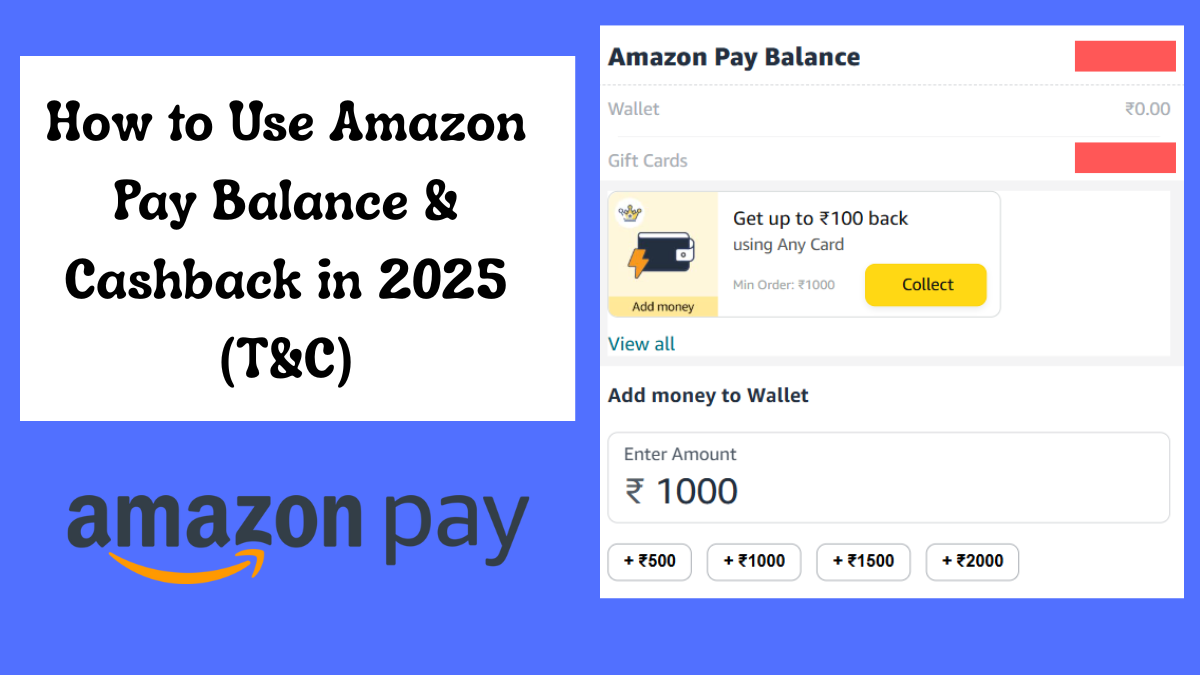

- Amazon Pay Balance consists of 2 different components which are Wallet and Gift Cards. Therefore, total Amazon Pay Balance= Amazon Pay Wallet + Amazon Pay Gift Cards.

- Amazon Pay Wallet includes the funds that you load via ‘add money’ feature. This can be used for purchases on Amazon and few other 3rd party apps such as Zepto, Swiggy, Zomato, etc. You can also use it for mobile recharge, electricity, gas and insurance payments. Balance added via UPI/Debit card can be used to send money for full KYC customers.

- Amazon Cashback includes cashback rewarded to you for completing certain payments. This cashback can be used for future purchases on Amazon (similar to wallet for light bills, recharges, etc) or on supported 3rd-party apps. However, one cannot withdraw it or transfer it to a bank account. Amazon Cashback is credited to your Amazon Pay Balance (as gift card balance) and not credited to your Amazon Wallet (hence cannot be withdrawn or transferred).

- Amazon Gift Vouchers are added to your wallet. However, you can only and only use them on Amazon such as for shopping, renewing Prime subscription, etc.

Now that your confusion is hopefully clear, let’s move on to the main topic of our article – how to use cashback earned in Amazon or best ways to use Amazon Pay balance.

On a side note, sign up on Zingoy to earn free cashback on 1000+ popular stores online including Amazon, Flipkart, Myntra, Ajio, Nykaa and a lot more. 😍😍😍

First, let’s understand the basics – how and where can we use our Amazon Pay Cashback?

How and Where to use Cashback Earned on Amazon?

You can use Amazon Cashback in mainly two ways; first, on Amazon itself and second, on select 3rd-party apps. We will understand both of these ways to use Amazon Cashback in detail below.

First, let’s begin with using Amazon Cashback on Amazon itself.

How to use Cashback earned on Amazon for Amazon Purchases and Payments?

For shopping:

- Open Amazon website or app

- Add the products you wish to buy to your cart

- Proceed to payment, select “Amazon Pay Balance”

- Here, you’ll see your accumulated balance including earned Amazon Cashback + Wallet balance + Gift Vouchers.

Important Note: After May 2024, Amazon has stopped allowing partial payments. This means, you cannot combine Amazon Pay Balance + credit card/debit card/UPI or other payments. The entire order value must be paid via your Amazon Pay Balance or any other payment method.

For Amazon Pay payments:

- To use Amazon Cashback, open the Amazon Pay section here

- Here, scroll down to recharges and bill payments

- Select a bill you wish to pay and on the payment window, choose “Amazon Pay Balance”

- You can use Amazon Cashback to pay for mobile recharges, DTH, electricity, gas, water, broadband, subscription services (JioHotstar, Prime Video, SonyLIV, Zee5, Norton, etc), landline bills, municipality tax, LPG cylinder, cable TV, etc.

- Important Note: Amazon Pay Balance is not supported for transactions related to electricity, piped gas, water, municipal tax, landline, broadband, cable TV, mobile postpaid, LPG payment where amount is beyond Rs.20,000.

- For insurance premiums, the new limit is Rs.25,000 for using Amazon Pay Balance

Now that you know how to use cashback earned on Amazon for bills and shopping, let’s understand how to use Amazon Cashback on other 3rd party apps.

How to Use Amazon Pay Balance on Other Apps? Use Cashback Earned on Amazon on other apps

- To use Amazon Pay balance on other apps, open an app of your choice

- Make sure it supports Wallet Payment >> Amazon Pay Balance

- Some of the Amazon Pay Balance supported apps are Swiggy, Zomato, Zepto, Blinkit, Uber, Ola, Rapido, UTS, MyJio, FNP, Clovia, Giva, BookMyShow, District, etc

- While proceeding to payment, select “wallet option”

- Choose Amazon Pay

- Link your Amazon Pay account to the app

- Pay with the cashback earned on Amazon or Amazon Pay Balance

Important note: This Amazon Pay Balance won’t include your gift vouchers balance. You may ask, will it include funds that I add in my Amazon Wallet? The answer is yes. Tip: That’s a trick some users use to get extra 2% to 5% cashback. IFYKYK😏

.

Top 3 Best Ways to Use Amazon Pay Balance

There are many, many ways to use your Amazon Pay Balance or Amazon Cashback but there are some ways that go one step further in helping you save money (the whole point of why people search for ways to use Amazon Pay Balance).

Below we have jotted down some of such best ways to use your Amazon balance in 2025 (India).

- Pay Electricity, Gas, Water and Mobile Recharge Bills, Broadband, Municipality Taxes using Amazon Cashback or Amazon Pay Balance

One of the best use-cases of Amazon Pay Balance is for paying bills. Many users seem to underestimate how useful this is. Some credit card experts load their Amazon Pay Balance using select cards that reward cashback on wallet load and then use their Amazon Pay Balance to pay for bills. For example, Indus cards offer 1 RP/200 but the wallet limit is 20k per billing cycle. You can do max 25k but 1% fee above 20k. The newly launched Roar Bank RuPay Credit Card offers 5% cashback on multiple merchants including Zomato (Hint: Load your wallet using Zomato – 4K per month limit). You can use your Amazon Pay Balance for a wide range of bill payments including municipality taxes, water bills, LPG Cylinder, mobile recharges, broadband and landline bills, etc (except for your credit card payment).

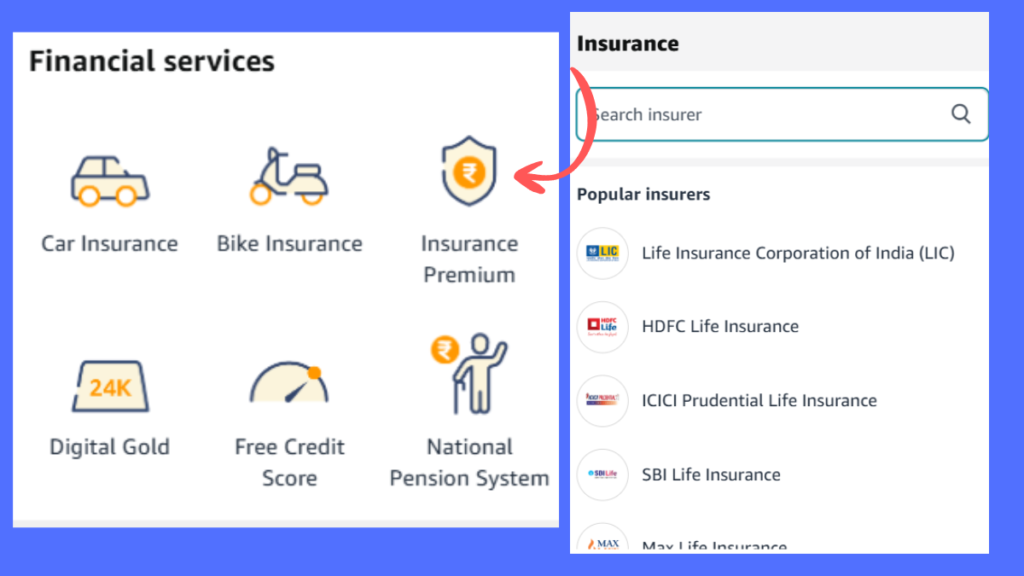

- Use Amazon Pay Balance to pay Insurance Premium

Another great use of Amazon Pay Balance is paying insurance premium. You can pay for this right from the Amazon Pay section >> Insurance premium >> enter issuer name >> enter insurance policy number. Again, if you want to take this up a notch, add Amazon balance using cards that reward you for wallet load. Some insurance issuers such as HDFC Life Insurance official website also supports payment via wallet option including Amazon Pay. Note that the limit is upto 25K for insurance premium.

- Use Amazon Pay Balance to pay for groceries and food

One of the best ways to use your Amazon Pay Balance is on groceries and food. Several apps including Swiggy, Zomato, Magicpin, Zepto, Blinkit, Big Basket, Amazon Fresh, etc all support wallet payment options with Amazon Pay Balance.

.

List of 3rd-party apps that accept Amazon Pay balance as payment {Verified}

- Uber

- OLA

- Rapido

- Swiggy

- Zomato

- Magicpin

- BigBasket

- Zepto

- Blinkit

- Swiggy Instamart

- Amazon Fresh

- Amazon Pharma

- MyJio

- UTS

- Ease My Trip

- Amazon Pay (powered by MMT)

- Goibibo

- Ixigo

- MakeMyTrip

- Samsung India

- FNP

- Clovia

- HDFC Life Insurance

- Policy Bazaar

- Zouk

- JustHerbs

- The Man Company

- District

- BookMyShow

- Giva

- Licious

List of 3rd-party apps that DO NOT accept Amazon Pay balance as payment {Verified}

- Flipkart Minutes

- Dominos

- Zivame

- Airtel Thanks app

- Myntra

- Puma

- Adidas

- Nike

- JioMart

- Ajio

- FirstCry

- Tata Play

- Malabar Gold

- IRCTC Hotel Booking (website)

- Mahavitran Electricity

- BillDesk

.

Amazon Pay Balance for Bill Payments Terms and Conditions

- Amazon Pay Balance = Amazon Pay Wallet + Gift Card / Cashback / Credit balances

- Full KYC wallet balance cap: ₹100,000 at any time

- Gift cards / unused balance expire 1 year from issuance

- Gift cards / Amazon Pay balance cannot be redeemed for cash or transferred for value

- Balance is redeemable on eligible purchases (not valid for apps, certain global store items, or other Amazon gift cards)

- Read official terms and conditions here

.

Amazon Pay Balance for Insurance Payments Terms and Conditions

- You can pay insurance premiums through Amazon app, website, or mobile site under the Amazon Pay >> Bills >> Insurance Premium section.

- Supported insurers are listed on the Insurance Premium page within Amazon Pay.

- Policy number can be found on your insurer’s website, your policy document, or payment reminder.

- Processing time (TAT): LIC: up to 2 business days and other insurers: 4–5 business day

- It’s advised to pay premiums at least 2 business days before the due date.

- Eligible payment methods for Insurance Premiums: Amazon Pay Balance (only for payments below ₹25,000), Net Banking, Amazon Pay Later, UPI.

- From the 6th insurance payment in a calendar month, only Amazon Pay UPI is allowed.

- Credit cards are not supported for insurance premium payments due to Amazon’s internal guidelines.

- Payment receipt can be downloaded from Your Orders on Amazon.

- The official insurer receipt is issued directly by the insurer (for LIC, sent via [email protected]).

- Refunds for insurance premiums: Instant for Amazon Pay Balance payments and 2–4 business days for other methods (depends on your bank)

- Cancellation: Once paid, insurance premiums cannot be cancelled or refunded.

- Transaction limits: Amazon Pay Balance – up to ₹25,000 and Amazon Pay UPI – up to ₹2,00,000 and For payments above ₹2,00,000 – use Net Banking

- Amazon reserves the right to cancel any insurance premium payment without prior notice.

- Lapsed policies must be revived directly with the insurer, based on their rules and timelines.

- In case of any conflict, English version of terms will be considered final.

- Read official terms and conditions here

.

Amazon Pay Wallet Terms and Conditions

- Amazon Pay Balance = Amazon Pay Wallet + Amazon Pay Gift Cards

- Wallet holds the money you add yourself.

- Gift Cards store cashback, refunds, and gifted balance.

- You can check the full breakdown at amazon.in/gp/payment/statement.

- No expiry for Amazon Pay Wallet (unless mandated by RBI).

- No usage charges from Amazon, but merchants may have their own fees.

- Wallet loading fee: Only applies when adding money via credit card, 2.36% (2% + 18% GST). Example: Add ₹100 → charged ₹102.36. No fee if you add money via UPI, debit card, or net banking.

- Official ID number required (RBI rule) to add money to the Wallet.

- Gift Card balance can be used without ID update.

- Small Account allows limited features

- Full KYC Account provides full access (send/receive money, higher limits, etc.).

- Check KYC status in Account Settings.

- Amazon Pay Wallet UPI ID: mobile@amazonpay linked to your Wallet, not your bank. No UPI PIN needed.

- Amazon Pay UPI ID: mobile@apl linked to your bank account.

- You can set up the Wallet UPI only on the Amazon app (not desktop).

- Top up at amazon.in/gp/sva/addmoney.

- Funds are usually added instantly (may take up to 15 min).

- Cash load option: up to ₹50,000/month (for Full KYC users).

- Monthly Add Money limits: Min KYC = ₹10,000/month and Full KYC = ₹5,00,000/month and Per transaction max = ₹2,00,000 and Wallet balance cap = ₹2,00,000

- No MPIN needed for Wallet UPI payments.

- Pay on Amazon.in and 10,000+ partner apps (Ola, Swiggy, Uber, etc.).

- Pay bills, buy gift cards, shop online.

- Cannot combine Amazon Pay Balance with other payment methods on checkout.

- If the balance is low, add money first and retry.

- Instant refunds for payments made via Amazon Pay Balance.

- Per Amazon Wallet UPI transaction: ₹1,00,000

- Monthly spend (merchant payments): ₹1,00,000

- Bank transfers: up to 20/day, ₹1,00,000/month

- Collect requests: max 5/day, up to ₹2,000 each

- Incoming credits: Max 10 credits / 24 hours and ₹10,000 per credit transaction and Max ₹5,000 total spend allowed in first 24 hours from your first transaction

- Amazon may restrict transactions if unusual activity is detected.

- Temporary daily limit (₹5,000) may apply during review.

- Restrictions are auto-lifted once the account is verified safe.

- Refunds are returned to original payment source (Wallet or card).

- Refund timeline: 2–4 business days.

- Cashback credited to Gift Cards balance within 3 days after shipment.

- To close Wallet or deregister Wallet UPI contact Amazon Customer Service >> amazon.in/contactus

- You can set per-transaction spend limit and daily transaction limit

- Not applicable to Gift Card balance.

- Default monthly spend limit, small account: ₹10,000 and Full KYC: as per RBI cap

- Read official terms and conditions here