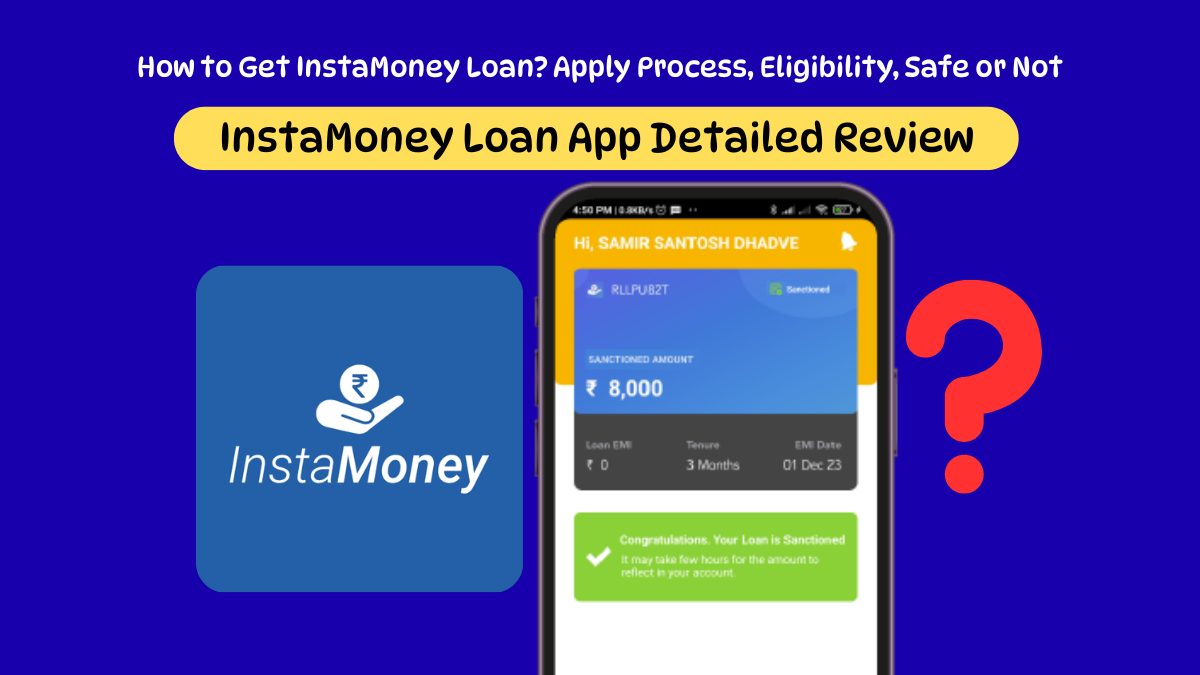

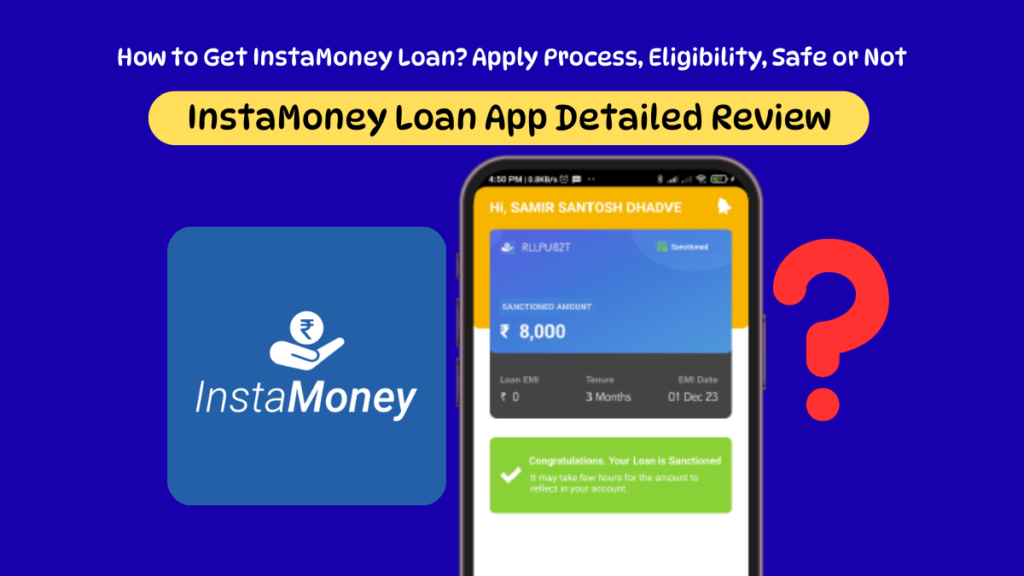

InstaMoney Loan app offers quick personal loan via its RBI-registered lending partner Innofino Solutions Pvt Ltd. Users can apply for a quick loan from Rs.5000 to Rs.50,000 without any paper work (except for submitting digital copies of your PAN and Aadhar card). But, there’s a caveat. InstaMoney charges a fee of Rs.199 for “application assessment” which is non-refundable (BE CAREFUL). In this article, we will help you understand what is the InstaMoney Loan app, application process, eligibility, interest rate and more importantly is the InstaMoney app safe or not and important things you need to know.

What is InstaMoney?

InstaMoney is a quick loan app that provides unsecured loans (no collateral needed) to borrowers for interest rate starting from 24% per annum. The USP of InstaMoney is that it offers quick loans without any income proof.

Want to earn free cash?😍 Sign up on Zingoy and earn free cashback on your online shopping from Amazon, Flipkart, Myntra & other stores. It’s 100% free and rewarding😍Download the Zingoy app today.

.

InstaMoney Loan Benefits and Features

Following are the benefits and features of InstaMoney:

- Get instant loan upto Rs.50,000

- Foreclosure option is available

- Loan is provided via RBI-registered lending partners Innofin and Aeroflex Finance

- Short-term loans are available for tenures between 3 to 12 months

- Processing fee is 6% + GST

- User-friendly app interface with real-time tracking

- Unsecured loan – no collateral required

- 24/7 Loan facility

InstaMoney Loan App Disadvantages or Cons

Following are the cons or disadvantages of using InstaMoney Loan app that every new borrower must know:

- High processing fee of 6% whereas other loan apps charge 3% or so

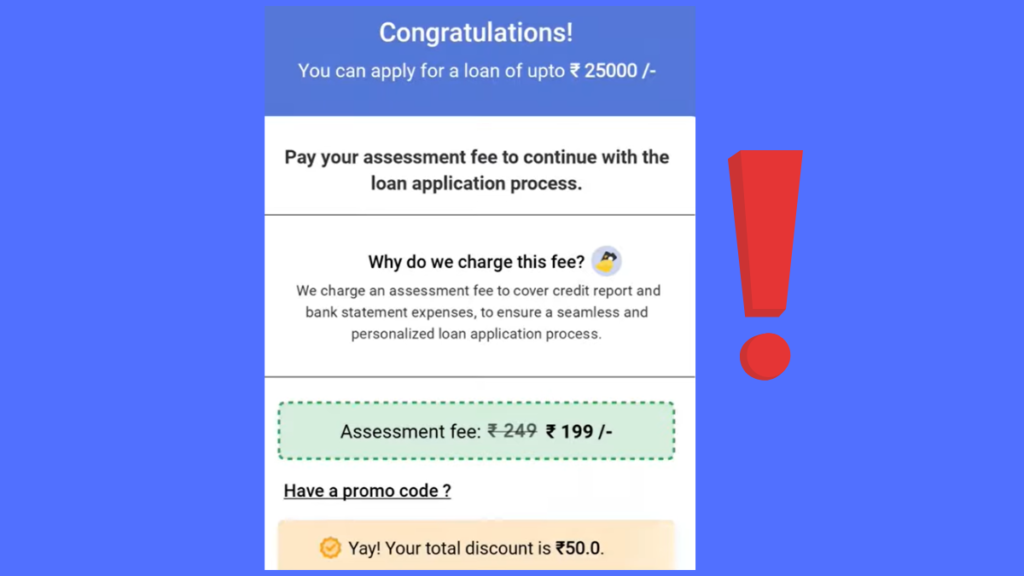

- A loan application assessment fee of Rs.199 is charged (non-refundable) even before the loan is approved or sanctioned. Without this, you cannot proceed further.

- This loan assessment fee is only applicable till 2 months or loan agreement whichever is lesser. This means, if you wish to try your luck again, you need to pay the fee again to check your loan eligibility.

- Interest rates are very high – 24% to 48% per annum whereas other apps like Cred Cash interest rates start from 14% or so.

- Requires mandatory permissions of camera, device data, installed apps, location and phone number (contacts)

- Some users have reported issues like double EMI debits, delayed refunds and delayed loan disbursements

- Customer support isn’t great. Users can only use Email support and even that seem to have auto-generated replies.

Cred Cash Loan is far better than InstaMoney for instant loans, read our article to know more✔️✔️✔️

Take part in Zingoy Black Friday Rush and earn extra cashback and freebies!😍😍😍

What is InstaMoney Loan Interest Rates

InstaMoney loan app interest rates starts from 24% and goes upto 48% depending on the borrower profile and employment details. If we compare InstaMoney Loan app interest rates to other instant loan apps, here’s how InstaMoney flairs:

Comparing the top popular instant loan apps interest rates in India

| InstaMoney Loan interest rate vs Others | |

| InstaMoney Loan Interest Rate | 24% to 48% per annum |

| Cred Cash Loan Interest Rate | 14% to 45% per annum |

| Navi Instant Loan Interest Rate | 9.9% to 45% per annum |

| Slice Loan Interest Rate | 18% to 48% per annum |

| KreditBee Loan Interest Rate | 12% to 28.9% per annum |

It’s pretty clear InstaMoney Loan interest rates are among the most expensive ones out there.

Get upto ₹1000 cashback on LoanHub with Zingoy😍

InstaMoney Loan Eligibility Criteria

- The applicant must be an Indian citizen.

- The age limit must be 21 to 55 years at the time of application.

- Should be salaried or self‑employed with regular income (even though app markets “no income proof”, risk assessment still depends on your income profile).

- Must have valid KYC ( PAN card and Aadhaar card)

- Must have an active bank account for disbursal and EMI auto‑debit

- Your registered phone number must be linked to your bank account

- Mandatory one‑time, non‑refundable “application assessment” fee of about ₹199 to ₹249 is charged before final approval, which you lose even if the loan is rejected (you cannot proceed further without paying this)

- Requires you to provide mandatory permission to contacts, location, installed apps, device data and camera

- Minimum income and credit profile should meet the lender’s internal policy

How to Apply for an InstaMoney Loan? Apply Process

- Download the InstaMoney app here

- Next, open the app and allow the mandatory permissions of Camera, Device Data, Installed Apps, Location and Phone Number

- Make sure you’ve read the terms and conditions carefully before

- Enter your phone number

- Your entered phone number must be linked to your Aadhar card and bank account

- Enter OTP

- Sign in with an email ID

- Complete your application by filling other details such as Full Name, PAN, DOB, Pincode

- Select your preferred language (English, Hindi, Marathi, etc)

- Enter employment details

- Choose employment type between salaried or self-employed

- For salaried individuals, enter your job position, company name and salary details

- For self-employed, enter Business Name (such as Kirana or Plumber or Medi Clinic, etc )

- Next, enter loan amount required between Rs.5000 to Rs.50,000

- Enter interest rate preferred (select the lowest 24% pa)

- Next, a new page will load asking you to pay an “assessment fee” of Rs.199 or Rs.249

- This fee is non-refundable so whether your loan is approved or rejected, you won’t receive it back (this is where many InstaMoney receives a lot of backlash)

- If you still wish to proceed, pay the fee

- Once paid, you’ll be redirected to a new page asking you to wait for at least 7 days to receive your loan eligibility status

- After or within this 7-days period, if your loan is approved, your loan amount will be disbursed in upto 2 hours

- Your loan amount will be transferred to your bank account

- EMIs are auto-debited from the same account (you also get an option to pay your EMIs by yourself)

Is InstaMoney Loan App Safe?

InstaMoney Loan app is considered safe to use as per the guidelines of Google Play Store. However, users have reported several issues with the app and an extra, non-refundable, “loan assessment fee” of Rs.199 or Rs.249 before even your loan is approved or rejected does raise some eyebrows. Thus, one needs to be careful. For example, did you know InstaMoney recommends paying your EMI dues manually at least 24 hours before the due date OR allow auto-debit to take place on the due date (1st of every month) to avoid double EMI debit issues? In short, make sure you have read the complete terms and conditions before using InstaMoney Loan app.

InstaMoney Loan App Customer Care

InstaMoney is registered as Roctogen Services Pvt. Ltd and their office address is GALA-2 CTS NO 141 KUBER, CHEMBERS, DATTA MANDIR RD, Malad East, Mumbai- 400097, Maharashtra, India.

- InstaMoney Loan App Customer Care Contact Number: 8976766423

- InstaMoney Loan App Customer Care Email: [email protected]

InstaMoney Debited EMI Twice. What to Do?

InstaMoney says that its Lending Partner will refund the extra EMI within 2 working days and you’ll get a notification. To avoid this, pay manually at least 24 hours before the due date or let auto-debit run on the 1st.

Can I Pay the EMI before the Due Date in InstaMoney Loan App?

Yes, you can pay early. If auto-debit is active, pay 2–3 days before the due date to avoid duplicate charges.

How to Cancel InstaMoney Loan?

If your loan application is incomplete, the Lending Partner will automatically cancel or let it expire after 30 days of inactivity.

How to Foreclose InstaMoney Loan?

Yes, you can foreclose your InstaMoney loan before the tenure ends.

Steps to Foreclose Your Loan:

- Open the InstaMoney application and go to the dashboard.

- Click on the “Pay Due” option.

- Select the “Closure Amount” to proceed with the loan foreclosure.

- Choose your preferred repayment method and complete the payment.

- Once the payment is successfully processed, your loan will be closed, and you will receive a No Dues Certificate (NDC) for confirmation.

- It can take upto 10 days for the lending partners to report your loan closure to credit bureaus